Earnings From a Limited Partnership Would Be an Example of

One of our clients had taxable investment income from various investments of approximately 200000 consisting of rental income and interest from bonds and trust deeds that he owned. The payout can be in the form of capital payment or income.

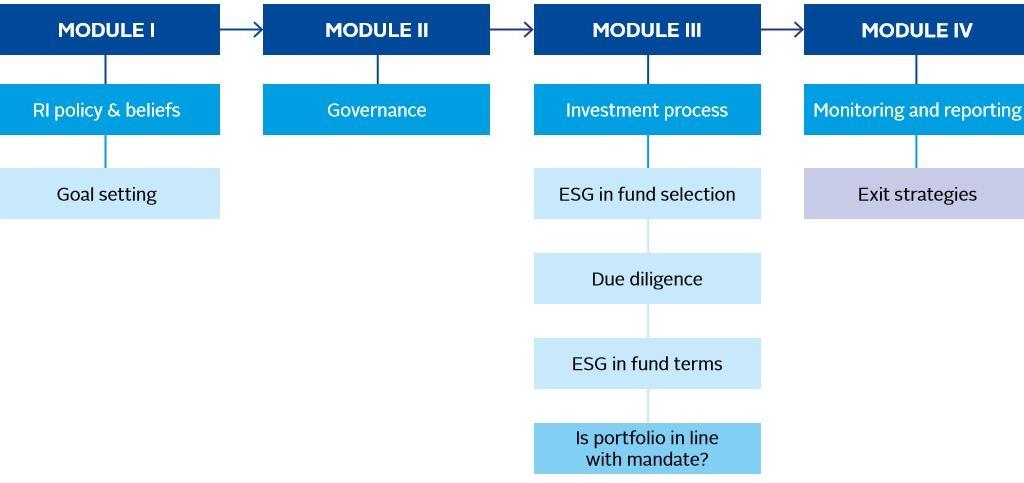

Guide For Limited Partners Responsible Investment In Private Equity Section 3 Technical Guide Pri

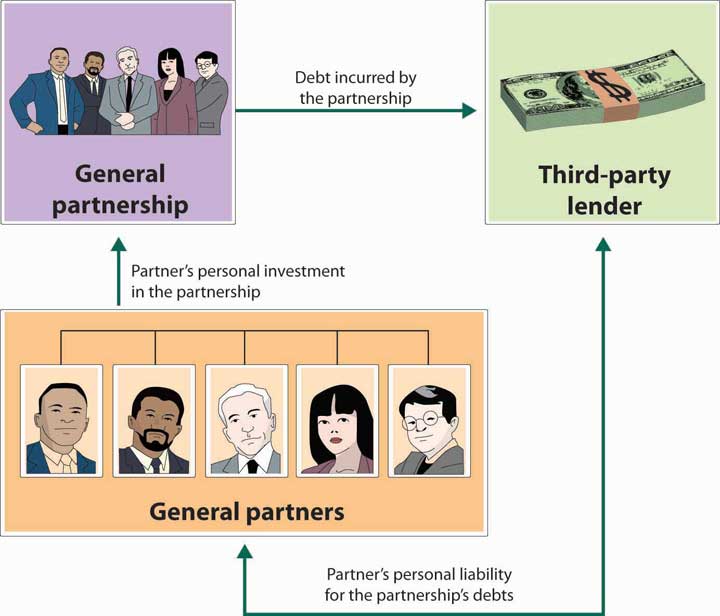

In other words the partnerships business income flows down to the partners and is taxed only once in the partners hands.

. The partnership or incurred in the same manner as incurred by the partnership. Earnings from a limited partnership would be an example of _____ income. A Limited Liability Company is created that will be the General Partner in the Family Limited Partnership FLP.

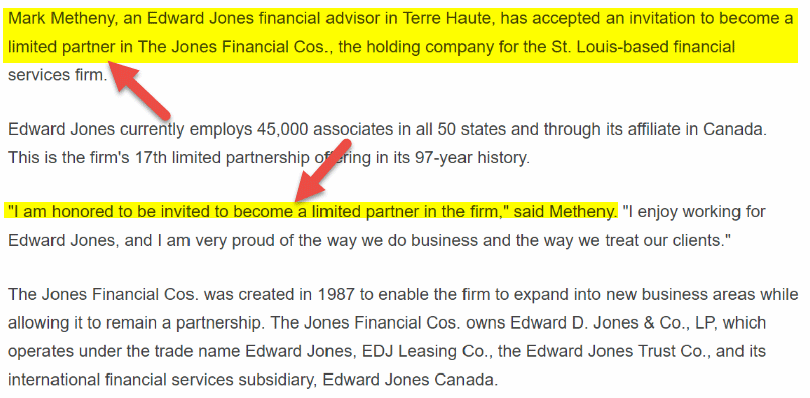

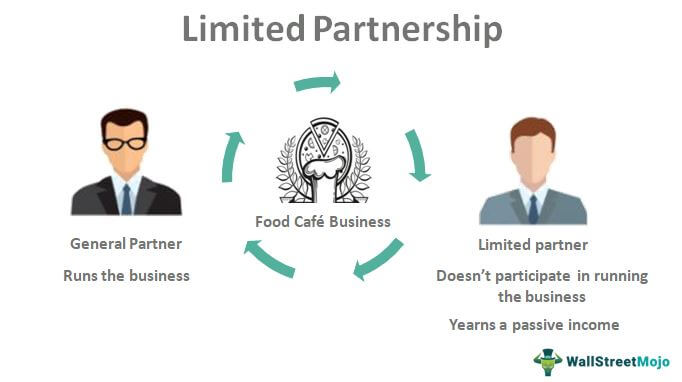

A limited partnership LP exists when two or more partners go into business together but the limited partners are only liable up to the amount of their investment. Ernest Young is a professional service firm from London England formed by LLP. Family Limited Partnership There is an important distinction between family partnerships and family limited partnerships.

Finally IRC 704a provides that a partners distributive share of income gain loss deduction or credit is generally determined by the partnership agreement. Earnings from a limited partnership would be an example of income A passive 2 Earnings from a limited partnership would be an School University of New Brunswick. Limited partnerships that do business in California and other states must apportion their income using Apportionment and Allocation of Income Schedule R PDF.

Meanwhile the partnership expects Dec. 1469-5Te3ii it would be necessary to inquire into the nature and extent of the partners or members authority to act on behalf of the entity. An amount not included in gross income is called _____ alimony payments.

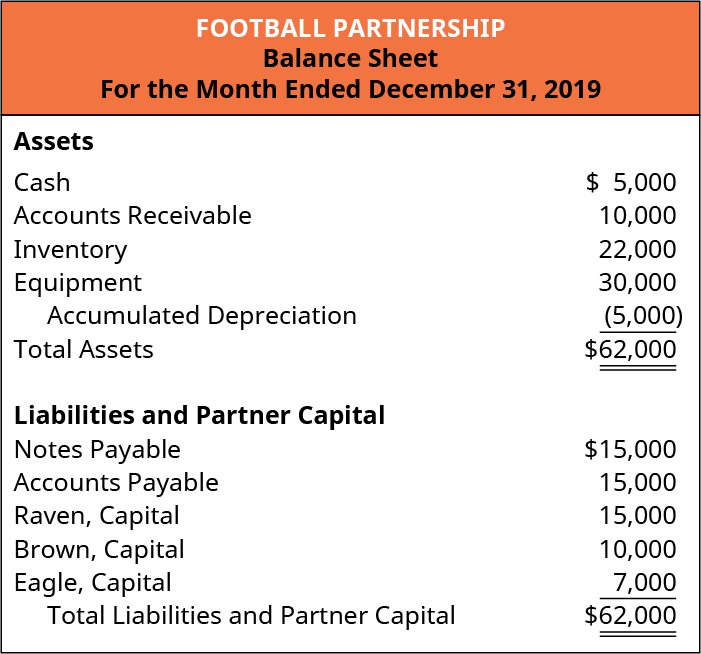

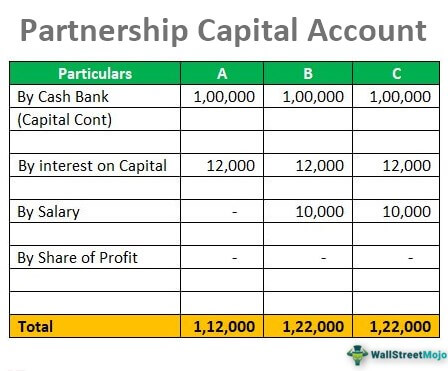

There are limitations to how many individuals each can be associated. The first distribution would be of salary of 3 million to be paid to Indus. 465 4879 Views.

As an example in the case of a limited partnership between Anna Bob and a few others only Cheshire Land Development Limited is a general partner in the partnership. FPL NextEras largest business segment announced 028 earnings per share up from 025 earnings per share in the same quarter last year. If the partnership owns property that when sold would generate ordinary income then the sale of the partnership interest will also generate ordinary income.

The Canadian Income Tax legislation covering limited partnerships is designed to prevent limited partners from claiming losses in excess of the money that they have put at-risk by virtue of their investment in the limited partnership. These units cannot be sold for at least five years and the partnership will payout 70 of cash earnings in the form of dividends. Two companies merged together.

Business and finance private equity. Hence in 1986 the Taxpayer Relief Act came up with a restriction that passive losses from limited partnership can be set off only against other passive income. A partnership does not pay taxes.

He paid combined federal and state taxes of 80000 per year on this income. Limited Partnership Losses Limited Partnership Losses and the At-risk Amount. This excludes certain family members like cousins and non-family members even if they are close friends of the family.

Earnings from a limited partnership would be an example of _____ income. A limited partnership is an effective method of preventing the liability of one or more partners when used. As part of an overall business plan that we established this investment income was routed.

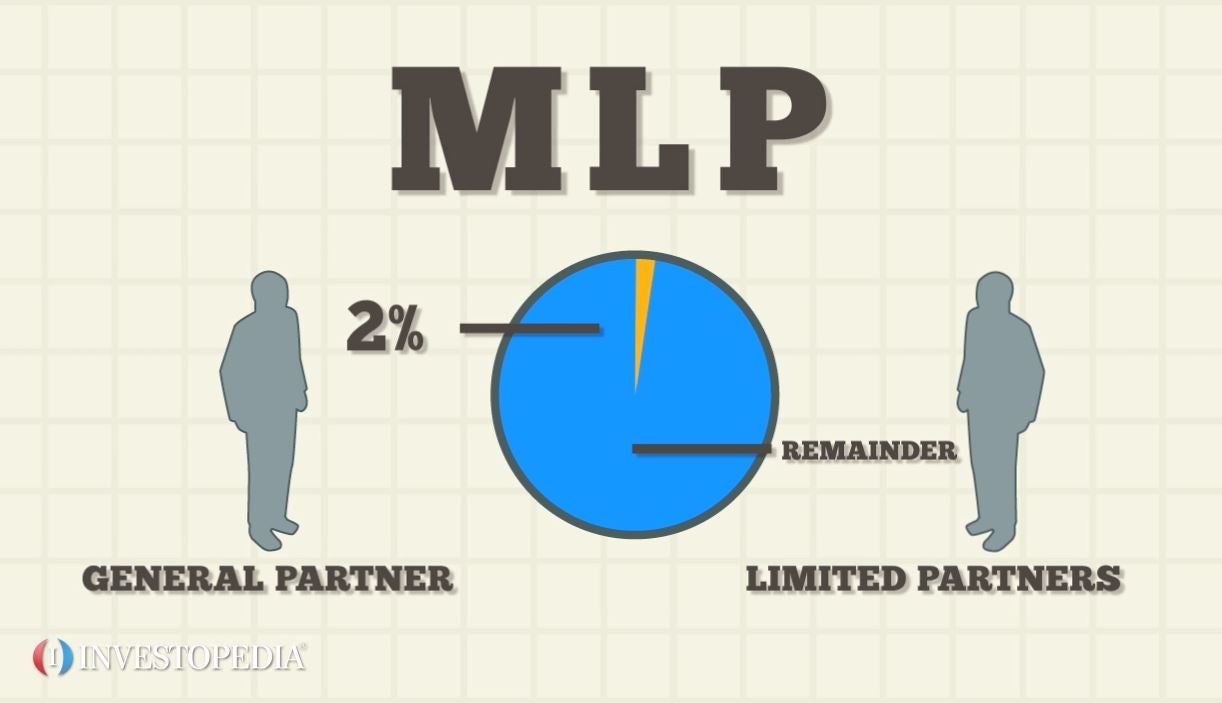

A limited partnership in which an individual owns a share of a business but. This is recorded by the following entry. A Family Limited Partnership is created with 100000 total units the General Partner interest holds 2 2000 units and the initial Limited Partner block holds 98 98000 units in our example.

The family limited partnership will issue 6000 limited partnership units or shares at 100 each to raise the required 600000 in starting capital. The interest on savings accounts is passive income. An amount not included in gross income is A a tax credit.

As an example suppose a partnership owns as its only asset inventory with a fair market value of 1000000 and a tax basis of 600000 and that Partner A a one-fourth partner. Limited Partnerships A limited partnership has been defined by the original Uniform Limited Partnership. Another option is a limited liability.

Partnerships are business structures allowing pass-through taxation. An LP is defined as having. The court went on to note that to determine whether an individual held a general partnership interest as well as a limited partnership interest for purposes of Temp.

In 2000 a Nevada limited partnership opens an office in California. 9 Votes Medical partnerships law firms and accounting firms are common examples of Limited Liability Partnership. A partnership distribution is when the partnership transfers cash or property to a partner.

Which of the following would be deducted from gross income to obtain adjusted gross income. Distribute the partnership income according to the arrangement explained above. Music and book royalties and property rent payments are examples.

A family limited partnership is very similar to an LLP but all of the members must be related to the general partner as a spouse or as parents children and lineal descendants commonly referred to as grandchildren. Active income includes salaries wages and commissions where you need to. 2022 run rate for adjusted EBITDA of 1775B to 1975B and.

Second distribution is the interest paid on opening capital balance. If the partnership is unequal such as a 30-70 ratio then youd need to document the percentages assigned to each partner in the partnership agreement more on that later. A passive B investment C portfolio D earned E excluded.

These two companies are both limited partners. Instead the partners are assigned the items of income and loss charged because of the partnerships activities.

Limited Partnership Overview Taxation And Examples

Guide On How To File Your Income Tax As A Partnership Limited Liability Partnership Llp Or Limited Partnership Lp Dollarsandsense Business

4 Types Of Business Structures And Their Tax Implications Netsuite

Discuss And Record Entries For The Dissolution Of A Partnership Principles Of Accounting Volume 1 Financial Accounting

Guide For Limited Partners Responsible Investment In Private Equity Section 3 Technical Guide Pri

Reading Sole Proprietorship And Partnerships Introduction To Business

:max_bytes(150000):strip_icc()/dotdash_Final_Private_Equity_Apr_2020-final-4b5ec0bb99da4396a4add9e7ff30ac03.jpg)

Private Equity Definition How Does It Work

/dotdash_Final_Private_Equity_Apr_2020-final-4b5ec0bb99da4396a4add9e7ff30ac03.jpg)

Private Equity Definition How Does It Work

Guide On How To File Your Income Tax As A Partnership Limited Liability Partnership Llp Or Limited Partnership Lp Dollarsandsense Business

Limited Partnership Meaning Liability Vs General Partnership

/dotdash_Final_Private_Equity_Apr_2020-final-4b5ec0bb99da4396a4add9e7ff30ac03.jpg)

Private Equity Definition How Does It Work

Limited Partnership Meaning Liability Vs General Partnership

Guide On How To File Your Income Tax As A Partnership Limited Liability Partnership Llp Or Limited Partnership Lp Dollarsandsense Business

Partnership Overview Of Different Types Of Partnerships

Guide On How To File Your Income Tax As A Partnership Limited Liability Partnership Llp Or Limited Partnership Lp Dollarsandsense Business

The Many Uses And Benefits Of A Variable Capital Company International Bar Association

Reading Sole Proprietorship And Partnerships Introduction To Business

Comments

Post a Comment